PA 854: Macroeconomic Policy and International Financial Regulation

This site provides resources for students in PA 854

at the University of Wisconsin,

Madison for Spring 2012 Semester

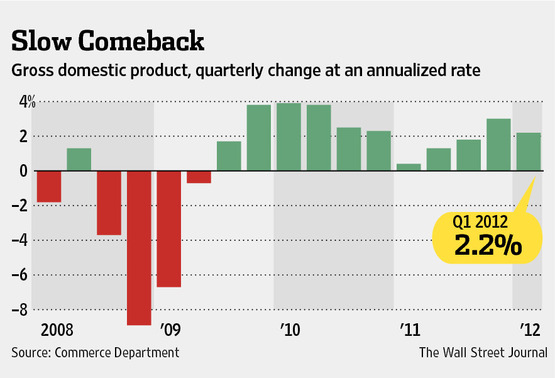

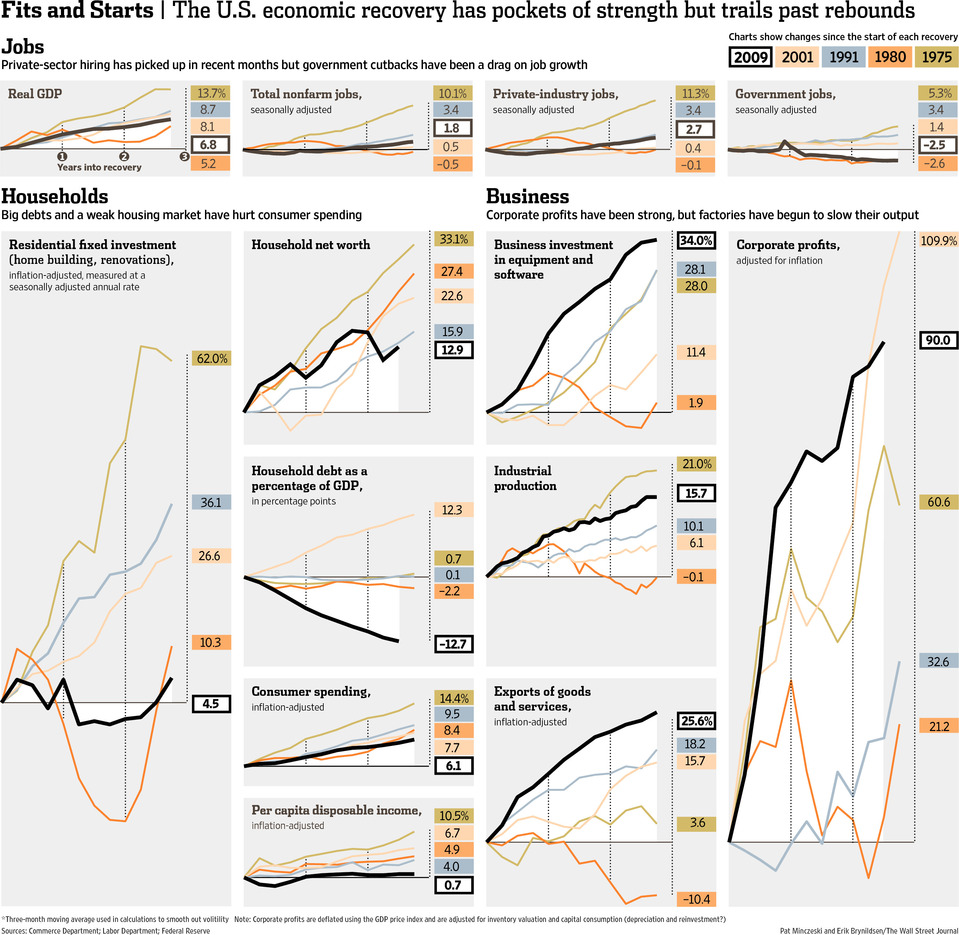

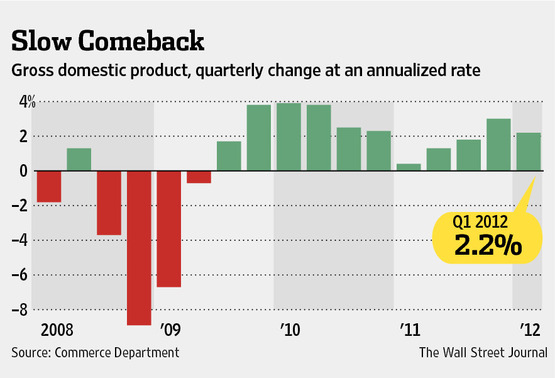

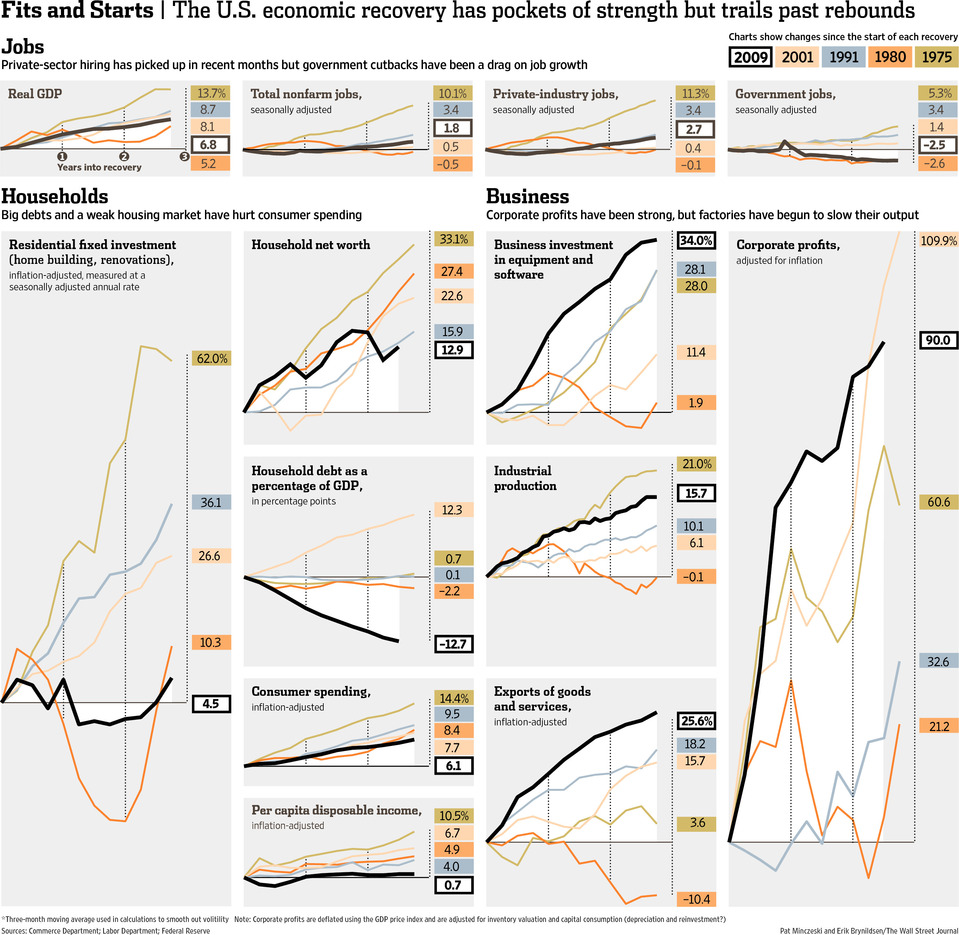

Source: Ben Casselman, "Slowing Growth Stirs Recovery Fears," Wall Street Journal, April 28, 2012.

Syllabus |

Important Dates |

Downloadable Course Materials and Information Sources |

Robert M. LaFollette School of Public Affairs |

Department of

Economics

LECTURE: MW 11-12:15 Education L155

Instructor

Professor Menzie Chinn

Office Hours: MW 4-5

7418 Social Sciences

Tel: (608) 262-7397

email:

mchinn@lafollette.wisc.edu

Home Page

PA854 Syllabus in PDF file.

This course surveys international macroeconomics, with special reference to international monetary policy and international financial market architecture. Topics include the structure of international financial markets; the role of central banks; exchange-rate systems; the determination of balance of payments and exchange rates; macroeconomics of open economies; policy analysis for open economies; policy coordination; the International Monetary Fund; and financial crises.

The aim of this course is to provide an analytical background for those who plan to go into government service, international organizations and agencies, businesses involved in the global economy, nongovernmental organizations with international foci, and consulting firms analyzing international policy issues.

The textbook is Caves, Frankel and Jones, World Trade and Payments 10th Edition, available at the University Bookstore.

Additional assigned readings will be available on the Web (via links on this website).

- Midterm 1: March 7

- Midterm 2: April 23

- Term paper due: May 11.

Downloadable Course Materials

Required Readings

- IMF, World Economic Outlook, October 2011 Chapter 1.

- White House Council of Economic Advisers, The Economic Report of the President, 2012, Chapter 1.

- TriennialCentral Bank Survey Report on global foreign exchange market activity in 2010 (Basel: BIS, December).

- M. Chinn, 2004, “Incomes, Exchange rates and the U.S. trade deficit, once again,” International Finance 7(3): 451-469.

- M. Pakko and P. Pollard, 2003, “Burgernomics: a big Mac guide to purchasing power parity,” Federal Reserve Bank of St. Louis Review 85(6): 9-28.

- K. Herve, 2010, “The OECD's New Global Model,” Economics Department Working Paper No. 368 (Paris: OECD, December).

- M. Brunnermeier, forthcoming, “Deciphering the Liquicity and Credit Crunch of 2007-08,” Journal of Economic Perspectives.

- M. Chinn, 2006, "The Rehabilitation of Interest Rate Parity in the Floating Rate Era: Longer Horizons, Alternative Expectations, and Emerging Markets," JIMF 25.

- M. Hutchison, 2003, “Is official foreign exchange intervention effective,” FRBSF Economic Letter 2003-20 (July 18).

- J. Frankel, 2003, “Experience of and lessons from exchange rate regimes in emerging economies,” mimeo (Cambridge: Harvard University, September).

- Aizenman, Chinn and Ito, "Assessing the Emerging Global Financial Architecture: Measuring the Trilemma's Configurations over Time," NBER Working Paper No. 14533. [pdf].

- "A Faith-based Initiative: Do We Really Know that a Flexible Exchange Rate Regime Facilitates Current Account Adjustment," mimeo [PDF].

News Reports and Additional Optional Readings

- D. Leonhardt, "Coming Soon: ‘Taxmageddon’," NYTimes, 15 April 2012.

- "Weak China GDP growth no signal for fresh stimulus," Reuters (April 13, 2012)

- "Fed doves and hawks show their feathers," Reuters

- Casselman and Meckle, "Jobs Recovery Gains Momentum," WSJ (March 10-11, 2012)

- Herve, et al., 2010, "The OECD's New Global Model," OECD Economics Department Working Paper No. 768.

- Robert McNally, "Managing Oil Market Disruption in a Confrontation with Iran," Council on Foreign Relations brief (January 2012).

- "Iran warns currency speculators as rial continues to fall," WaPo, Feb. 1, 2012.

- CBO, The Budget and Economic Outlook (January 2012), and additional materials.

- IMF, "World Economic Outlook Update: Global Recovery Stalls, Downside Risks Intensify," January 24, 2012.

- Summers memo to President-Elect Obama on Economic Work (12/15/08)

- Macroeconomic Advisers’ "The Economic Effects of the Ryan Plan: Assuming the Answer?" Macro Focus, APril 13, 2011

- Institute for New Economic Thinking conference agenda

- IMF Conference on Macro after the Crisis

- F. Norris, "Inexact science of the Jobless Numbers," NYT (Feb. 4, 2011)

- BIS, Triennial Central Bank Survey of Foreign Exchange and Derivatives Market Activity in 2010 (Nov. 2010)

- Aizenman, Chinn and Ito, "The 'Impossible Trinity' Hypothesis in an Era of Global Imbalances: Measurement and Testing," forthcoming, JIMF.

- White House, Budget of the United States, FY2012: Analytical Perspectives.

- Steindel, "Chain-weighting: The New Approach to Measuring GDP," NY Fed Current Issues (Dec. 1995).

- Summary and Chapter 2 from CBO, CBO, The Budget and Economic Outlook: Fiscal Years 2010 to 2020 (January 2010).

- P. Swagel, 2009, "The Financial Crisis: An Inside View," paper presented at the Brookings Panel on Economic Activity, March 2009

- Mathias Dewatripont, Xavier Freixas and Richard Portes, Macroeconomic Stability and Financial Regulation: Key Issues for the G20 (CEPR, March 2009).

News Sources

Other

Weblogs

Economics and Economic Policy Links

International Organizations

U.S. Government Agencies

Current and Historical Data

- Note: IMF, International Financial Statistics, and World Bank, World Development Indicators, available from DISC.

- St. Louis Fed economic database Thousands

of time series on economic activity, in an easily downloadable form.

- Economic Indicators Many Department of Commerce economic series, all in one place.

- White House Economic Briefing Room Contains

current economic data.

- Economic Indicators Publication of CEA and Congressional Joint Economic Committee contains

recent economic data.

- Bureau of Economic Analysis, Dept. of Commerce Data on GDP and components (the national income and product accounts) as well as other macroeconomic data.

- Bureau of the Census, Dept. of Commerce Data on the characteristics

of the US population as well as of US firms.

- Bureau of Labor Statistics, Dept. of Labor Data on

wages, prices, productivity, and employment and unemployment rates.

- Energy Information Agency, Dept. of Energy Data on

on energy (electricity, gas, petroleum) production, consumption and prices.

- Statistical Abstract of the US

A compilation of statistics about the US, from government and nongovernment sources.

- Bank for International

settlements Effective Exchange Rate Indices.

- Economic Report of the President, various years. The back portion of

this annual publication contains about 70 tables of government economic data.

- NBER Data Specialized economic databases created by

economists associated with the National Bureau of Economic Research.

- NBER listing of economic releases Compendium of links to economic releases, and archived releases.

- Pacific Exchange Rate Service.

- Federal Reserve Board data Monetary, financial and output data

collected by the Nation's central bank.

- Penn World Tables Annual GDP and other data for over a hundred countries, expressed

in dollars, after adjusting for differing price levels.

PA854 Macro Policy & Int'l Financial Regulation / UW Madison / mchinn@lafollette.wisc.edu / 30 April 2012