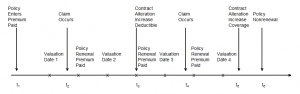

One way to describe the data arising from operations of a company that sells insurance products is to adopt a granular approach. In this “micro” oriented view, we can think specifically about what happens to a contract at various stages of its existence. Consider Figure 1.1 that traces a timeline of a typical insurance contract. Throughout the existence of the contract, the company regularly processes events such as premium collection and valuation, described in Section 1.3; these are marked with an “x” on the timeline. Further, non-regular and unanticipated events also occur. To illustrate, times “t2” and “t4” mark the event of an insurance claim (some contracts, such as life insurance, can have only a single claim). Times “t3” and “t5” mark the events when a policyholder wishes to alter certain contract features, such as the choice of a deductible or the amount of coverage. Moreover, from a company perspective, one can even think about the contract initiation (arrival, time t1 and contract termination (departure, time t6 as uncertain events.

Fig. 1.1. Timeline of a Typical Insurance Policy. Arrows mark the occurrences of random events. Each “x” marks the time of scheduled events that are typically non-random.

Does This Make Sense?

Quiz questions allow for immediate assessment of your understanding of a section. Try them out.