Understanding the Wisconsin Economy

Noah Williams, UW-Madison, nmwilliams@wisc.edu

Update: A Response to Comments

by Marc Levine

Recently there have been several stories in

the press (http://huff.to/1DHE1OF, http://bit.ly/1aYoGSS, http://bit.ly/1OOKHRp ) that

provide a misleading picture of the economy in the state of

Wisconsin. These

stories base their economic analysis on the rankings by state

of job growth and wage growth from Quarterly Census of

Employment and Wages provided by the Bureau of Labor

Statistics. (A

press link to the data is here: http://bit.ly/1OkQ5Ro.) The

most recent statewide rankings show that Wisconsin has slipped

into the 40th place in job growth and 42nd

in wage growth. While

these figures are accurate, they provide a very limited and

misleading outlook on the statewide labor market and broader

economy. In

particular, a look at broader data shows that the economy in

Wisconsin is much healthier than these indicators suggest, and

has outperformed the overall national economy in many ways.

Employment

·

Looking

at broader labor market data shows that Wisconsin has

significantly outperformed higher ranked states like Michigan,

and has outpaced the national average along many dimensions.

The job growth indicator does not provide

an accurate overall impression of the labor market and

employment dynamics in each state. For example, economies

which were hardest hit by the recession of 2007 would need to

have higher job growth simply to return to the same place. To

be sure, the economy in North Dakota, which has been

consistently at the top of the rankings for the past several

years, is booming, with employment growth driven largely by

the energy boom. But the rankings also show that Wisconsin has

been ranked between 31st and 41st over

the past three years, while Michigan has been regularly in the

top ten until slipping a bit recently. However looking at

broader labor market data shows that Wisconsin has

significantly outperformed Michigan, and has outpaced the

national average along many dimensions.

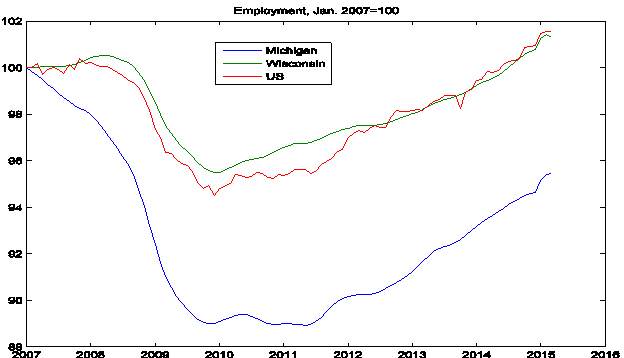

The figure above shows the employment data,

drawn from the BLS Household Survey, which provides the more

commonly used data underpinning the unemployment rate. The figure shows

employment for Michigan, Wisconsin, and the US as a whole,

with January 2007 indexed to 100. The figure makes clear

that employment growth in Michigan has indeed been relatively

rapid since the middle of 2011.

But this was largely due to the fact that employment

had collapsed so dramatically in the recession from 2007-2009,

and so employment remains 4% below its 2007 level. By

contrast, Wisconsin tracks the national average rather

closely. The

recession was somewhat milder in Wisconsin than in the nation

as a whole, and so job growth after the recession was somewhat

slower. But over the past three years job growth in Wisconsin

tracks the national average rather closely. Thus although job

growth in Wisconsin has not matched some of the fastest

growing states, it has been at least as strong as the national

average.

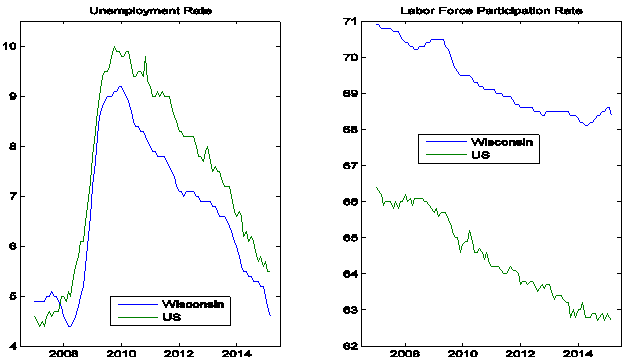

Some other indicators highlight other

aspects of the labor market where Wisconsin has outperformed

the national average. The

figure above shows the unemployment rate and the labor force

participation rate for Wisconsin and the US as a whole. The unemployment rate

in Wisconsin did not spike as dramatically as in the rest of

the nation during the recession, but even from the lower peak

it has fallen rapidly, especially over the past couple of

years. Since the beginning of 2014 the unemployment rate has

fallen by 1.5 percentage points, and now stands at 4.6% in

comparison to the 5.5% national average.

In addition, a significant component of the

reduction in the unemployment rate nationwide has been a

decline in the labor force participation rate. Some of the decline

in participation has been due to longer run demographic

factors, driven by the aging of the population. However a

significant component has been a cyclical, with unemployed

workers stopping searching for a job. The labor force

participation rate in Wisconsin has historically been above

the national average, and it has declined since 2007, but it

has increased over the past year and has been roughly stable

since the beginning of 2012. By comparison, if the labor force

participation rate in the US as a whole had remained constant

since January 2012 (rather than falling by one percentage

point), the national unemployment rate would now be 7.0%

rather than 5.5%. Thus the national unemployment rate hides

some additional weaknesses in the labor market which are not

present in Wisconsin, as participation in the state has

remained strong and even increased as the unemployment rate

has fallen.

Wages,

Earnings, and Income

·

Average

earnings growth in Wisconsin has matched higher ranked states

like South Dakota, and has been faster than the national

average. In addition, broader measures of household income

have increased recently in Wisconsin while falling nationally.

Beyond employment, earnings of workers and

incomes of households are important aspects of the economy. We

are not just interested in whether workers are employed but

whether households are improving economically. Along those

lines, the other labor market indicator which has been cited

recently has been the state rankings on wage growth. Overall, the data

there has been more mixed, with Wisconsin ranking in the 20s

or better for most of the period from 2011-2013, before

slipping to the 30s in 2014 and down to 42nd in the

most recent survey. North Dakota is again at the top of the

table for most of the sample period, and in addition South

Dakota is ranked in the top 10 for most of the period,

frequently in the top 5. Again, while this ranking sheds some

light on the earnings and incomes of workers in each state, it

provides an incomplete and perhaps misleading picture.

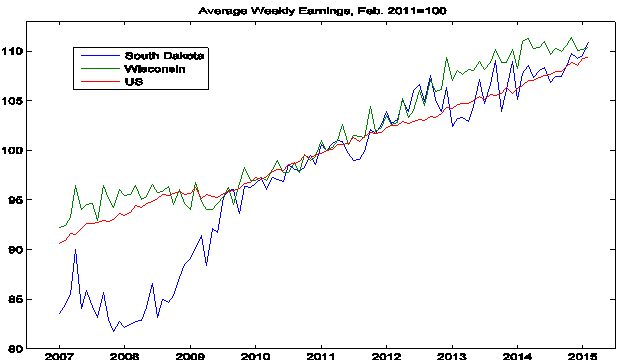

The figure above shows data from a

different source, monthly data from 2007-2014 on average

weekly earnings provided by the BLS. To make this data

comparable to the wage growth data in the Quarterly Census, I

have indexed February 2011 to 100, and I plot the data for

South Dakota, Wisconsin, and the US as a whole. Although the

data are noisy, the figure shows that rather than stagnating

or being outpaced by states like South Dakota, average

earnings growth in Wisconsin has matched South Dakota, and has

been faster than the national average. In particular, over

that span average earnings have grown by over 10% in

Wisconsin, more than one percentage point faster than the

national average.

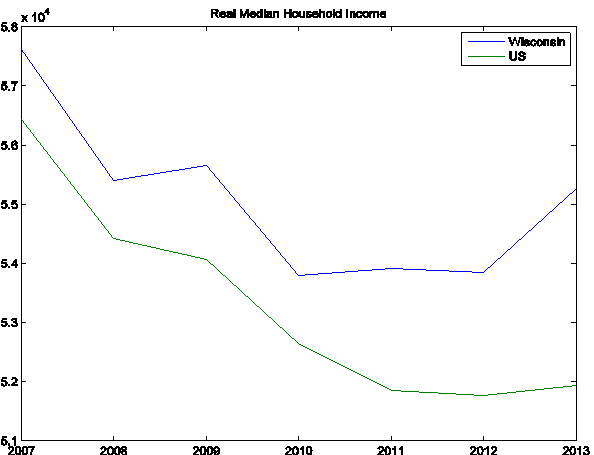

In addition, Wisconsin has done even better

when looking at broader measures of household income. The figure above shows

real median household income, provided by the Census Bureau on

an annual basis from 2007-2013 (the last date for which data

are available), in the United States and Wisconsin. Despite having only

a few data points, this provides a broader measure income for

a typical household, going beyond the labor market earnings

which were discussed above, and so arguably provides a better

indicator of household welfare.

Median incomes in Wisconsin have been above the

national average throughout the sample, and both have declined

from the pre-recession peak in 2007. But median incomes in

Wisconsin stabilized in 2011-2012 and grew significantly in

2013, while they continued to fall nationally in 2011 and

remained low thereafter. From the end of 2010, real median

household income in Wisconsin has grown by 2.7% while it has

fallen by 1.3% nationwide.

Summary

Overall, the economy of Wisconsin has

performed quite well since the end of the recession, and in

particular since the start of Governor Walker’s first term in

2011. To be sure, problems still remain and overall growth and

growth in employment have not yet reached their potential or

been as rapid as one might hope. Policies and other factors at

the national level impact the states and should not be immune

from sharing the blame. But the overall state of the economy

in Wisconsin is strong and improving.